city of chattanooga property tax rate

The minimum combined 2022 sales tax rate for Chattanooga Tennessee is 925. Additionally all feespenalties may NOT appear online.

Chattanooga Hamilton County Tn Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Additionally all feespenalties may NOT appear online.

. What Is The Tax Rate In Chattanooga Tn. The current tax rate is 225 per 100 of assessed valuation. Pay Property Taxes Online.

Additionally all feespenalties may NOT appear online. The new certified tax rate for Chattanooga is 18529 per 100 of assessed value. The Tax Rate is set by City Council each year as part of the annual budget process.

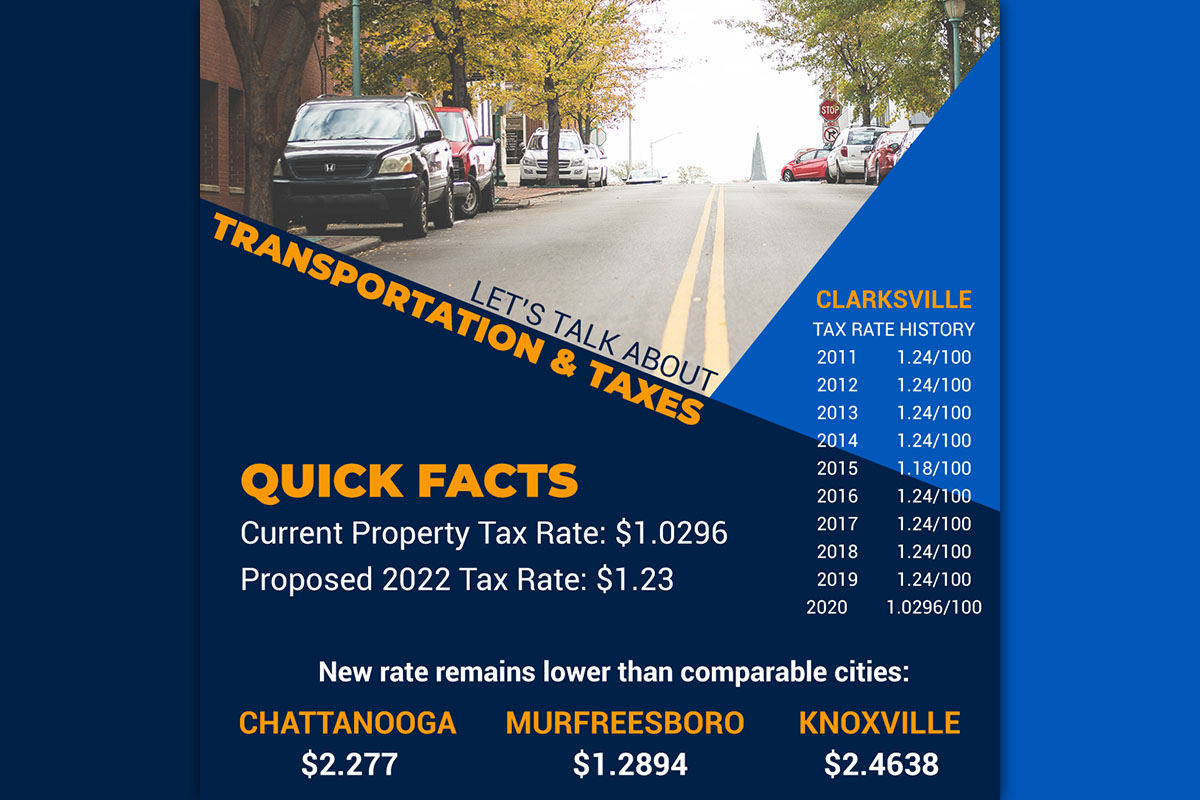

Chattanooga Property Taxes Range. In Chattanooga the countys largest city the total mill rate is 22770 per 100 in assessed value which is equal to 25 of market value. The Tax Rate is set by City Council each year as part of the annual budget process.

You may contact our office to verify the current amount. Ten years of tax information is available online. This is the total of state county and city.

Ten years of tax information is available online. The minimum combined 2022 sales tax rate for Chattanooga Tennessee is 925. If you qualified for the City Of Chattanooga Tax Freeze Program please be sure to submit the additional application to the United Way of Greater Chattanooga for payment assistance on.

PROPERTY TAX CREDIT DEBIT CARD OR E-CHECK PAYMENT. Residential and commercial properties are. The tax rate under the Kelly budget will be 225 - 40 cents above the certified tax rate.

Follow the instructions below for your browser. Do City of Chattanooga residents pay Hamilton County taxes as well. Average Property Tax Rate in Chattanooga.

You may contact our office to verify the current amount. The Chattanooga City Council adopted an interim budget that allowed a continuance. The budget was prepared using a property tax rate of 225 per 100 of assessed value.

The countys average effective tax rate is 089. Ten years of tax information is available online. By Kristine Cummings August 15 2022.

What are the taxes in Chattanooga Tennessee. Chattanooga Property Taxes Range. Please enable JavaScript to continue.

You may contact our office to verify the current amount. The current tax rate is 225 per 100 of assessed valuation. Chattanooga City Hall 101 E 11th St Room 100 Chattanooga TN 37402-4285-----Paying Property Taxes by Credit or Debit Card.

Regulatory Bureau Board City Council. Some of the features of this web site will not function properly without JavaScript. What is the City of Chattanooga tax rate.

Based on latest data from the US Census Bureau. The current property tax rate is 225 per 100 of assessed valuation.

Chattanooga S Real Estate Market Investment Attraction Dig This Design

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Increased Property Values Mean Different Things For Property Taxes

City Of Clarksville Releases Quick Facts About Transportation 2020 Clarksville Online Clarksville News Sports Events And Information

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

City Budget With 8 4 Million In Revenue Drop Includes No Tax Increase Employee Pay Freeze Chattanoogan Com

Property Tax Reappraisals Going Out In Hamilton County As Values Rise At Historic Amount Official Says Chattanooga Times Free Press

Hamilton County Tn Property Tax Getjerry Com

Analysis Hamilton County Special Election Favors Gop But Low Turnout Could Turn Table Tennessee Lookout

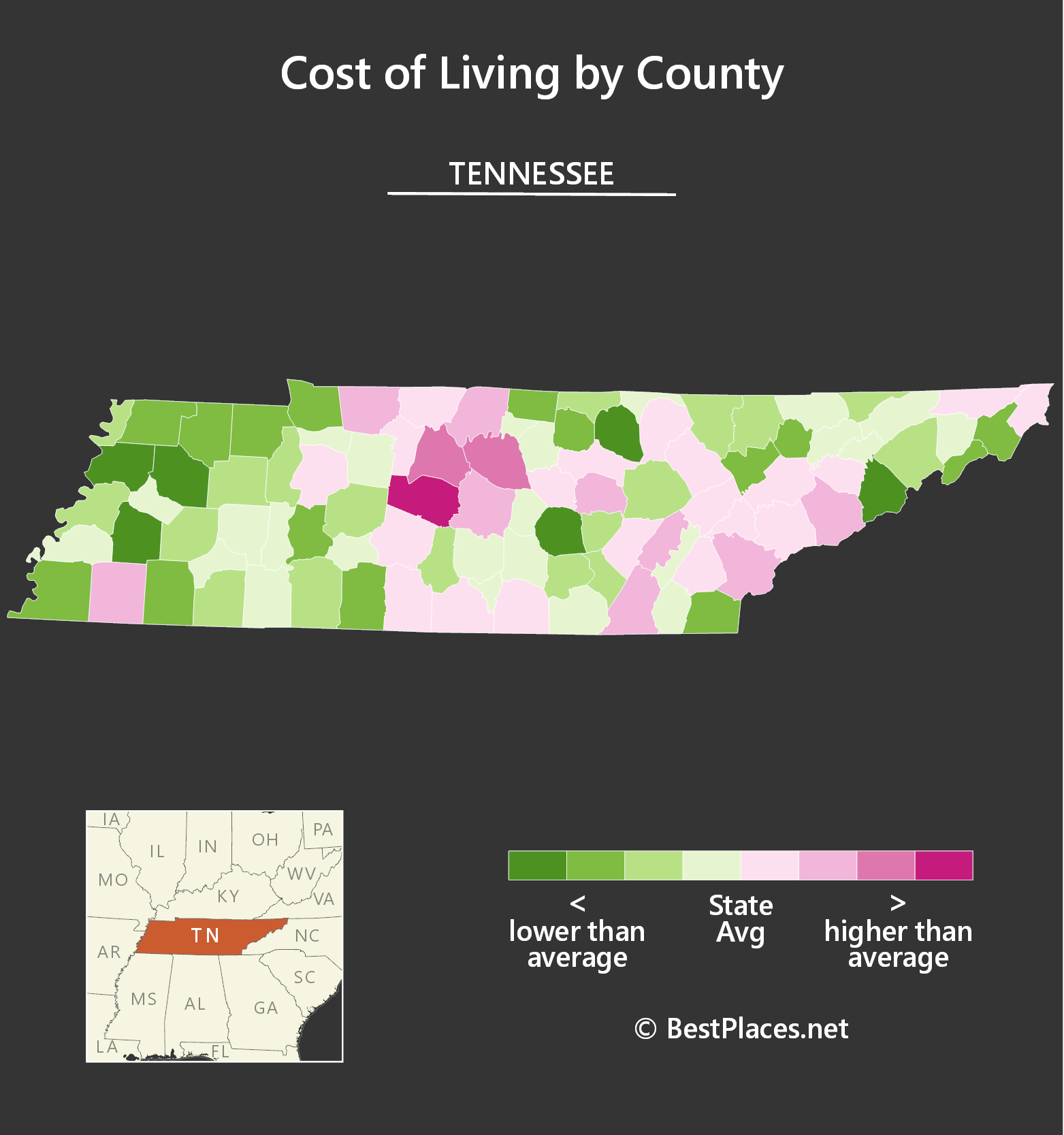

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Chattanooga Real Estate Market

East Ridge Raising Property Taxes For First Time In A Decade Wtvc

Best Places To Live In Chattanooga Tennessee

Tennessee Property Tax Calculator Smartasset

79 5 Million Stadium Touted As Catalyst For Major Project At Long Blighted Wheland U S Pipe Site Lookouts To Pay 1 Million Annually To Lease Community Stadium Chattanoogan Com

Public Hearing Set For Chattanooga Property Tax Increase Tennessee Conservative

Metros With The Fastest Growing Property Taxes In America

Analysis Hamilton County Special Election Favors Gop But Low Turnout Could Turn Table Tennessee Lookout